Instant Funding.

Simple, no credit check funding for EMD, Double Closing, and Stack Method (seller carry-back) deals - with access to over $100M in capital and the most experienced transactional funding team in the market today.

419

Deals Funded

$17.8M

Funded In 2025

243

Happy Borrowers

So What's It Cost?

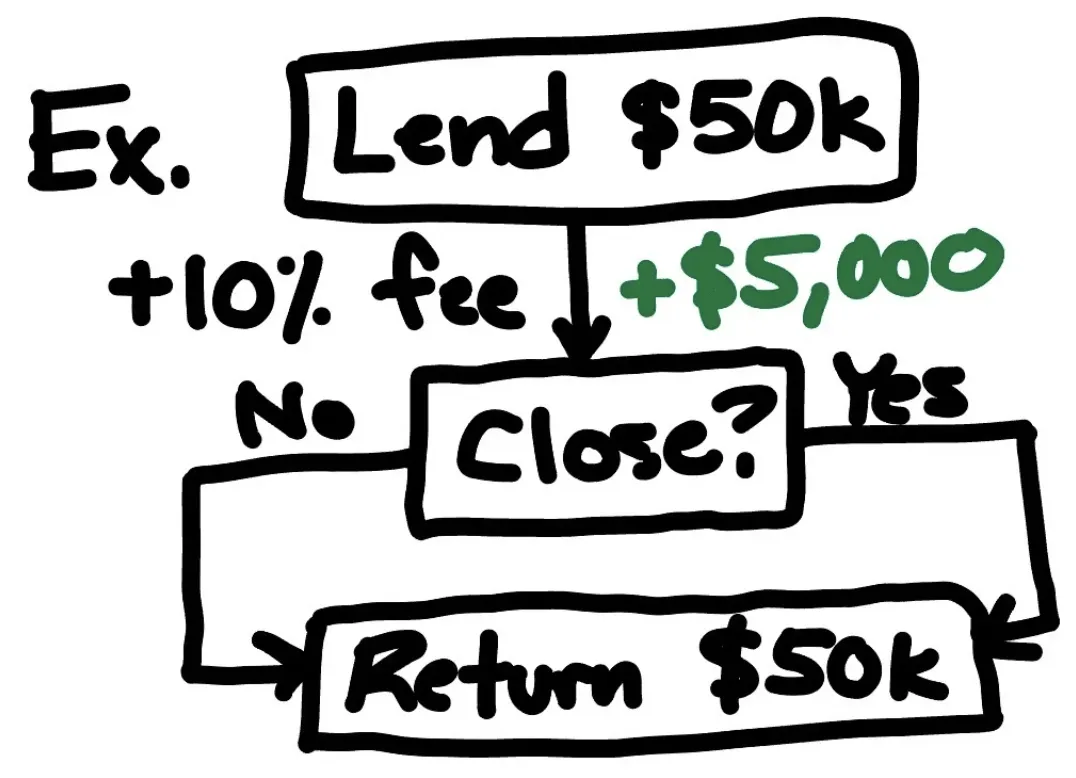

EMD Funding

We charge a flat 10% up-front return on all EMD deals and only fund up to $100k EMD. Deals over 30 days will have an additional fee. The 10% fee is non-refundable , and has a minimum of $1,500.

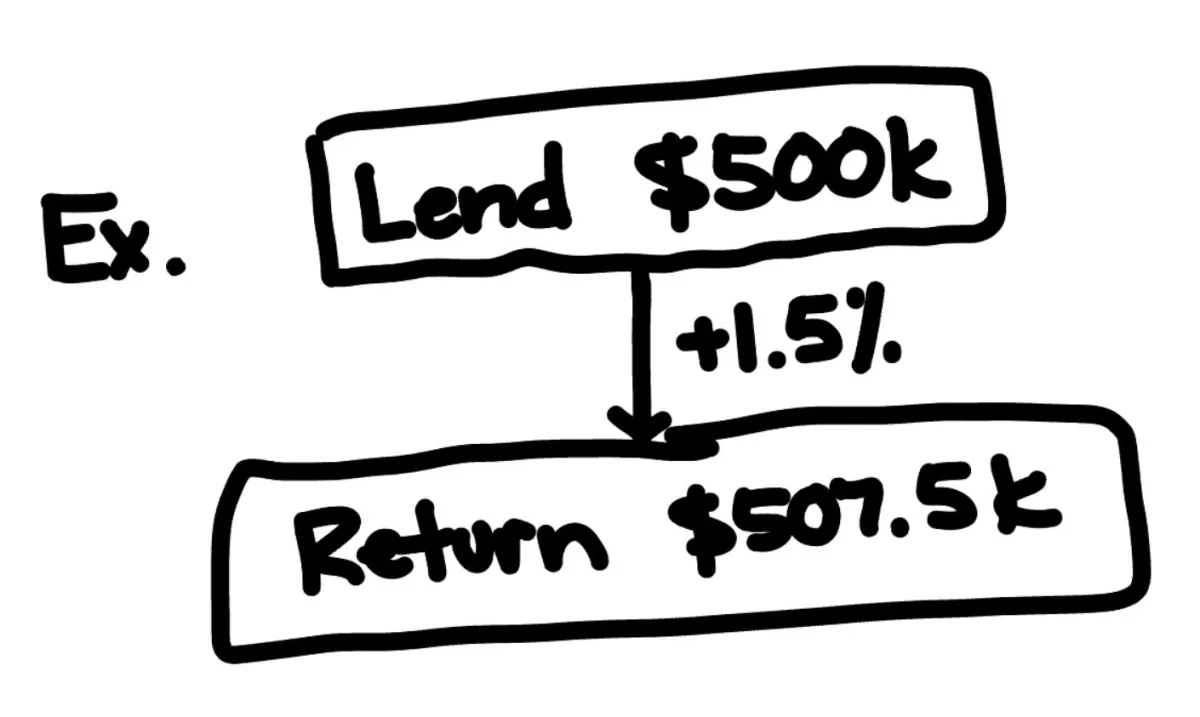

Double Close Funding

We charge a flat 1.5% fee on all same title company double closings up to $1M with at least 1 weeks notice. If you need the money quicker than that or are closing at separate title co. there will be an additional +1% fee. Our minimum return is $1,500 on smaller deals.

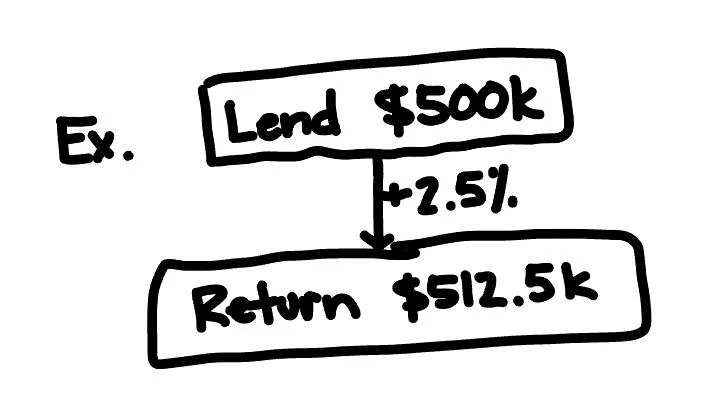

Stack Method Funding

We charge a flat 2.5% minimum fee on seller carry-back deals with at least 1 weeks notice. If you need the money quicker than that we will have to review to confirm. Our minimum return is $2,500 on smaller deals.

Frequently Asked Questions

How much do you charge?

We charge 10% up-front return for EMD (up to 30 days) and 1.5% for double close funding up to $1M to start. These numbers can change depending on duration of the deal and risks involved. Seller carry-back funding starts at 2.5% for the added work.

Are there any up-front fees?

For EMD, we charge the entire fee up front to pay our team for underwriting and processing the deal. Sadly we must do this so we don't end up losing money by funding your cancelled deal. This is significantly lower than what most people charge when a deal closes, so if you're confident in your deal you'll save lots of capital.

What qualifies as double closing?

A double closing is a real estate transaction method where two back-to-back property sales occur on the same day, involving three parties: the original seller, the wholesaler (investor), and the end buyer.

Here's how it works:

First Transaction: The investor agrees to purchase the property from the original seller.

Second Transaction: The investor simultaneously sells the property to the end buyer at a higher price.

During a double closing, the investor typically uses transactional funding (our services) to close the first transaction. This allows the investor to profit from the difference in sale prices without needing to use their own funds for an extended period. Double closings are often used in real estate wholesaling and transactional funding, allowing investors to efficiently facilitate deals and earn profits by connecting motivated sellers with interested buyers.

What qualifies as the Stack Method?

A stack method deal otherwise known as a seller carry-back occurs when the buyer gets a new loan to purchase the property, and then comes to an agreement with the seller for them to finance the down-payment behind the loan.

If your deal matches this structure, we will fund the down-payment for the first transaction until it is replaced with the money the seller is willing to finance to you after the purchase as agreed.

Can you fund EMD for end buyers?

We can fund EMD for end buyers if you and the seller sign an addendum making the inspection period go through the close of escrow. All details will be sent when your deal is submitted.

Is there a max amount you can fund?

We will fund up to $100k on EMD and $100M for double closings. As long as your deal qualifies under our standards, we will be your one stop shop for all transactional funding both now and in the future!

How quickly can we get our deal funded?

We typically require 48 hours of notice to fund a deal, however we have funded in as quickly as 5 minutes (seriously). If you have a deal, your best bet is to submit it as soon as possible so we can review it and get the process started.

What happens if the deal doesn't close?

If an EMD deal does not close, we just have the EMD sent back. Your only cost would be the up front fee and nothing else.

For double closing and seller carry-backs there would be no charge since we don't fund until closing.

Copyrights 2025 |